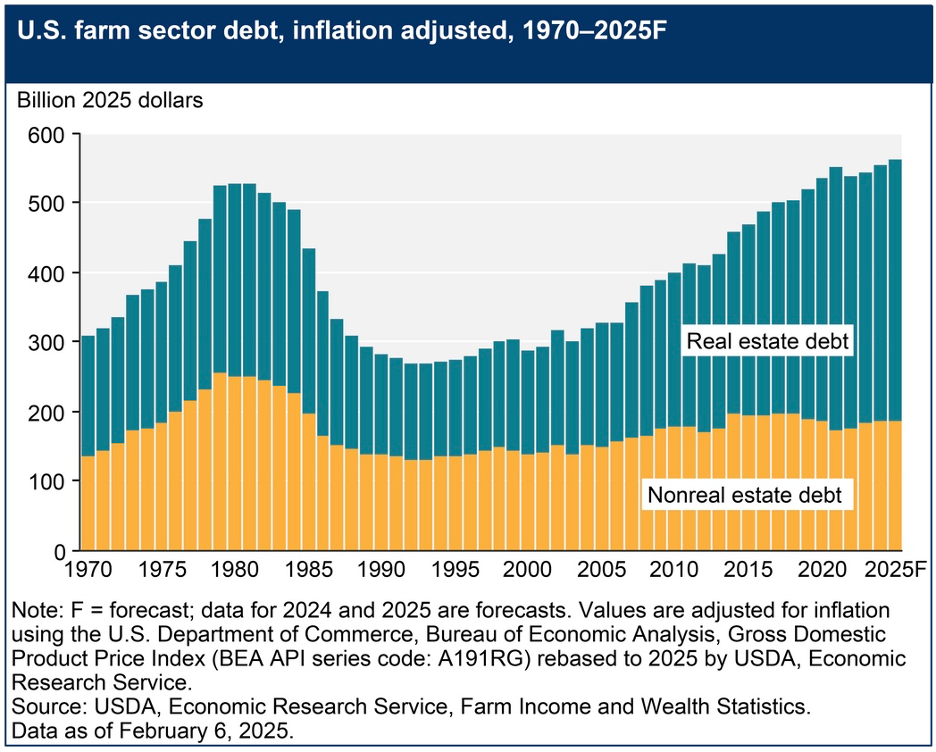

Debt

U.S. farm debt, after adjusting for inflation, has nearly doubled since 2000. Total farm debt adjusted for inflation, now exceeds the peak of debt around 1980, when interest rates of up to 20% destroyed hundreds of thousands of farmers.

https://www.ers.usda.gov/topics/farm-economy/farm-sector-income-finances/assets-debt-and-wealth

According to IPM Newsroom, “Non-real estate farm loans increased 25% last year, and other data suggests that trend will continue into 2025…. Nearly two-thirds of bankers surveyed in the upper Midwest and Montana reported increased loan demand this year, according to the Federal Reserve Bank of Minneapolis….”

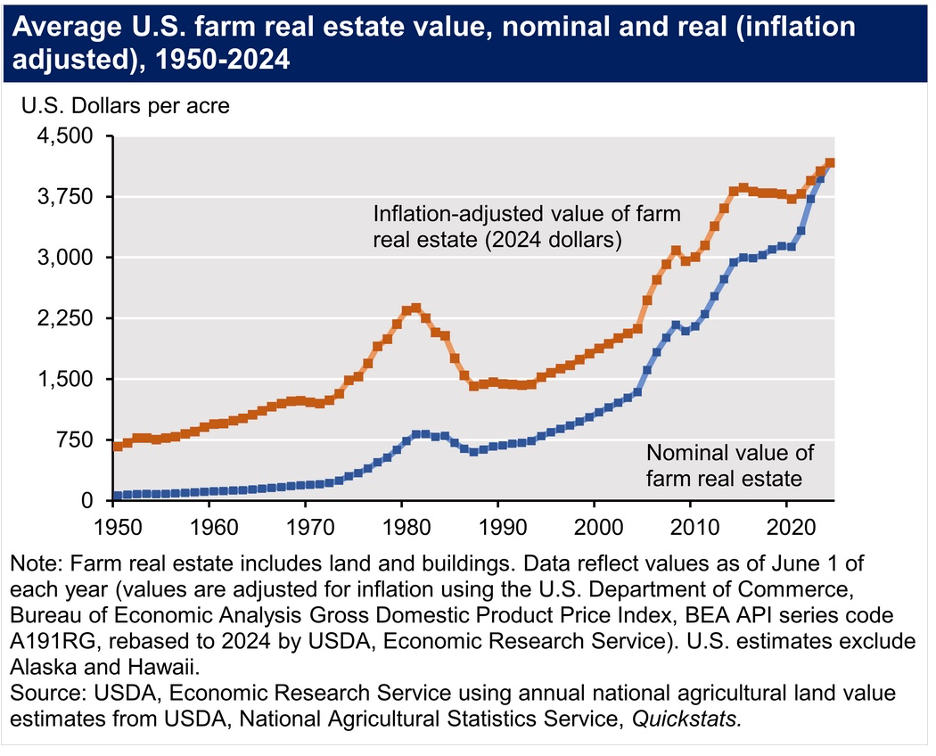

Meanwhile, the value of farmland has continued to rise. While this has enabled farmers to borrow more to keep their operations going, it also means they have become more indebted. And that means more of their land is at risk if the bad years continue.

In 2024, the value of U.S. farmland averaged $4,170 per acre. Even adjusted for inflation, the cost of farmland has nearly tripled since 1990, and increased 5 times since 1950. This has made it nearly impossible for young people, who want to get into farming, to come up with the cash or a loan to buy land and equipment, to embark on a career in agriculture.

https://www.ers.usda.gov/topics/farm-economy/land-use-land-value-tenure/farmland-value

Here is what Conterra, an agricultural lender, had to say:

“Lenders are reviewing everything from crop budgets to collateral before backing loans. Results from the American Bankers Association’s 2024 Ag Lender Survey show that just 58% of farm borrowers are projected to remain profitable this year, down sharply from 78% in 2023. That drop reflects a mix of pressure points: softer commodity prices, lingering cost inflation, weaker off-farm income in many rural areas, and increasingly erratic weather.”

Farmers are having a much harder time finding a bank to refinance their loans when they come due, if they lack the capital to repay in full. This is often when the family farm is lost.

Farmers usually borrow at the start of the growing season to buy inputs and replay their loans when they sell their crops. However, in 2025, farmers expect to lose $100 for each acre of corn they grew. Soybean prices are also down significantly.

And 160,000 farms have been lost between 2017 and 2024, according to the USDA. Many more losses are on the horizon.

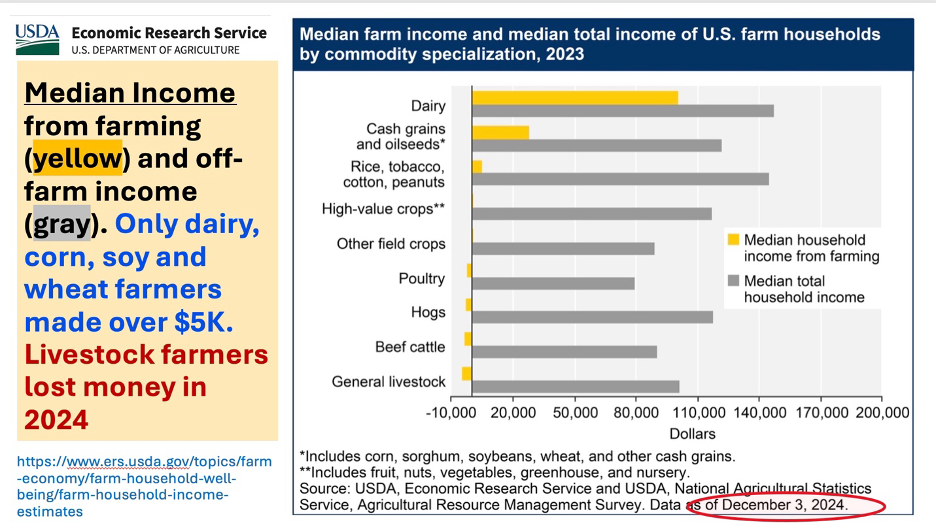

Farmers are land rich, since the price of land has skyrocketed. But they are cash poor, and few are making much money. This USDA chart says it all: in 2023, the average income for all ranchers and livestock farmers was negative. Their off-farm income from family members was all that kept them afloat.

How many U.S. farmers will be left in 5-10 years?