Crop Insurance

From the Environmental Working Group:

“Almost $37 billion in federal crop insurance payments went to a small number of insurance companies and agents, a new EWG analysis finds.

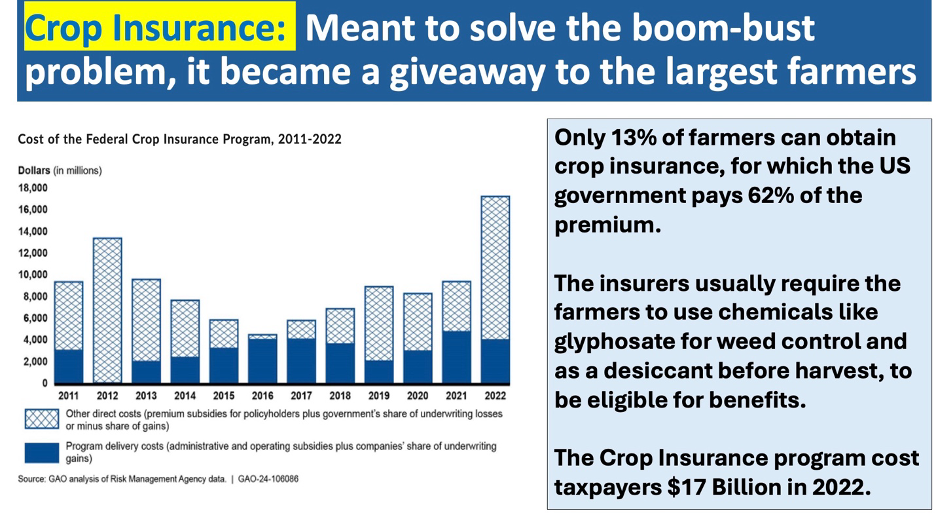

The Department of Agriculture’s Crop Insurance Program already pays billions of dollars every year to farmers experiencing reductions in crop yield or revenue. Taxpayers fund much of this.

But the program also pays billions each year to companies and insurance agents, EWG’s analysis finds. Between 2014 and 2023, the program paid out a total of $36.4 billion to agents and the 12 companies that the USDA allows to sell and service crop insurance policies, called Approved Insurance Providers.

Over the ten-year period, a little less than half of the total payments were made to companies and agents for “administrative and operating costs.” These cover costs like adjusting crop insurance claims and selling and marketing the policies. Agents get administrative and operating payments based on a percentage of the premium of every policy that they sell, but the companies can also choose to give them additional money, within statutory boundaries.

The remaining portion of the payments came from underwriting gains – the amount of money left over from taxpayer- and farmer-paid premiums when yearly losses are smaller than premiums. Although these gains are nominally not guaranteed, the government’s agreement with companies ensures a rate of return high above other insurance industries.

In the last 23 years, there were only two years when the crop insurance companies did not have underwriting gains.

Eight of the 12 crop insurance companies are owned by publicly traded corporations, six of which are headquartered outside of the U.S., in places like Switzerland and Japan. These corporations are huge firms with large assets and astronomical CEO salaries.

So taxpayers – with a median household income of only $80,610 in 2023 – and to a smaller extent farmers, are giving billions of dollars every year to wealthy corporations that do not need handouts.

Companies gain at taxpayers’ expense

Taxpayers have heavily subsidized the Crop Insurance Program for decades. They provide 63% of total premiums each year, on average, with farmers paying for the rest of their insurance premiums.

Instead of the USDA solely running its own program, like it does with farm subsidy and federal conservation programs, the agency relies on private companies to service crop insurance policies. The program has a unique “public–private partnership” that sends taxpayer money to companies. The companies then give some of the money to agents who sell policies and complete insurance adjustments.

While supporters of the Crop Insurance Program say it benefits farmers, a significant portion of the money pads the pockets of companies and agents.

EWG analyzed data from the USDA’s Risk Management Agency to find the total compensation to crop insurance companies and agents for the 10 years between 2014 and 2023.

The total was $36.4 billion, with just under half of the money – 47% – being paid out for administrative and operating payments, while 53% was for underwriting gains…

Of all 12 companies, only two are not owned by a parent company: Farmers Mutual Hail Insurance Company of Iowa and Precision Risk Management, LLC. One other crop insurance company, Country Mutual Insurance Company, is owned by a large private parent company, Country Financial. Because these companies are not publicly traded, little is known about them.

The other crop insurance provider, American Farm Bureau Insurance Services, Inc., is owned by the American Farm Bureau Federation. It’s a nonprofit organization that lobbies for the subsidies that guarantee the profitability of crop insurance companies.

A 2023 Government Accountability Office report showed just how high payments to crop insurance companies and agents have been, and that they will get more expensive in the future.

In 2022 alone, crop insurance companies earned commissions over $1 million per policy 14 times, covering some of America’s largest farms.

And the crop insurance companies received an average rate of return for their underwriting gains of 16.8% between 2011 and 2022. That’s significantly higher than the 10.2% rate of return that would be expected in a market setting not controlled by the government…”